Franklinton, Louisiana

March 17, 2022

6:00 p.m.

The Washington Parish School Board met in regular session on the above date with the following members present: John Wyble, Dan Slocum, Kendall McKenzie, Robert Boone, Dewitt Perry, Alan McCain, Lesley McKinley and Frankie Crosby. Absent: Bruce Brown.

Agenda Item #1 - Call to order

The meeting was called to order by -President John Wyble.

Agenda Item #2 – Invocation

The invocation was given by Lesley McKinley.

Agenda Item #3 – Pledge of Allegiance

Agenda Item #4 – Consider a motion to adopt the minutes of the February 10, 2022, regular board meeting (John Wyble).

It was moved by Frankie Crosby, seconded by Kendall McKenzie that the Board adopt the minutes of the February 10, 2022, regular board meeting as submitted to each member. Motion carried unanimously.

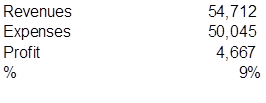

Agenda Item #5 – Presentation on January 2022 financial statements (Lacy Burris).

Lacy Burris, Director of Finance, presented the January 2022 financial statements for the following funds:

General Fund

School Lunch Fund

Tax District #4 Bond Sinking Fund

Agenda Item #6 – Discuss and take appropriate action regarding renewals for the Board’s property insurance (Lacy Burris).

It was moved by Alan McCain, seconded by Frankie Crosby that the Board approve the Board’s Property Insurance (exclusive of terrorism) with an annual premium of $525,299.00 with agent Arthur J. Gallagher Insurance for one year (Effective April 1, 2022) Motion carried unanimously.

Agenda Item #7 – Consider a motion to renew the contract of Norris Insurance Consultant (Lacy Burris).

Item deleted from the agenda.

Agenda Item #8 – Discuss and take appropriate action regarding Independent Accountant’s report on applying agreed upon procedures-Franklinton Primary School-Minda B. Rayburn, CPA, LLC (Lacy Burris).

It was moved by Dewitt Perry, seconded by Alan McCain, that the Board approve the Independent Accountant’s Report on Applying Agreed Upon Procedures – Franklinton Primary School as follows:

WASHINGTON PARISH SCHOOL BOARD

INDEPENDENT ACCOUNTANT’S REPORT ON

AGREED-UPON PROCEDURES

FOR

Franklinton Primary School

AS OF AND FOR THE PERIOD

July 1, 2020 through June 30, 2021

Minda B. Raybourn

Certified Public Accountant

Limited Liability Company

820 11th Avenue

Franklinton, Louisiana 70438

(985) 839-4413

Fax (985) 839-4402

WASHINGTON PARISH SCHOOL BOARD

INDEPENDENT ACCOUNTANT’S REPORT ON

APPLYING AGREED-UPON PROCEDURES

Washington Parish School Board

Franklinton, LA

I have performed the procedures listed below, which were agreed upon by the Washington Parish School Board and Superintendent. These procedures were performed solely to assist the school board management with respect to compliance with policy and procedures concerning individual school activity accounts and school property inventory at Franklinton Primary School for the period of July 1, 2020, through June 30, 2021. The school board’s management is responsible for the accounting and inventory records and for established policies and procedures over the student activity fund and school inventory. This engagement to apply agreed-upon procedures was performed in accordance with attestation standards established by the American Institute of Certified Public Accountants. The sufficiency of the procedures is solely the responsibility of the specified users of the report. Consequently, I make no representation regarding the sufficiency of the procedures described below either for the purpose for which this report has been requested or for any other purpose.

I tested inventory records to determine the physical existence of property as listed on the school’s property inventory report and to determine that property at the school was included on the inventory list. I also inspected property items to determine if they were identified as property of the school and numbered in accordance with the property inventory list. I examined the records for the school’s activity accounts. Three months of bank reconciliations were tested for completeness and mathematical accuracy. Disbursements were tested for proper use of requisitions, purchase orders and supporting documentation in relation to the school board policies and procedures. I tested bank deposits against pre-numbered receipts for propriety and traced them to the activity account ledger. I calculated gross profit percentages on concession sales and performed reasonableness tests on other receipt categories where applicable.

Bank reconciliations

Each month tested was mathematically correct, all reconciling items proper, and the reconciled balance equaled the activity account ledger. Beginning and ending balances were traced to prior and subsequent year balances to verify proper cutoffs with transactions recorded in the proper period and balances carried forward properly. The beginning bank balance at July 1, 2020, was $140,265, and the balance at June 30, 2021 was $160,868 resulting in a net increase of $20,603 for the year ended.

Cash Disbursements

School board policy requires that a properly executed requisition and purchase order be issued prior to the purchase or order of goods and services. In addition, an itemized invoice or other detailed documentation should support the payment.

I tested 14 disbursements. Out of the 14 disbursements, all had a purchase requisition, purchase order, and invoice or receipt. One check to Sam’s Club had purchase orders with no signatures. Except for this instance, purchase requisitions and purchase orders were all approved. Payment documentation was approved.

All invoices tested appear to be on a current basis, and the disbursement records were neat and orderly allowing the verification process to be accomplished in an efficient manner.

Cash Receipts

For each transaction, a computer-generated receipt is required to be produced. A total of 15 items were examined. I found all receipts and related documentation. The items tested were coded accurately to the correct fund.

The receipts tested were balanced to the daily recap and traced to the appropriate account in the activity ledger. Deposit tickets were complete and agreed with the daily report. The funds appear to be deposited timely.

Fundraisers

The school had one book fair. The book fair netted the school a profit of $1,664. Profits went to the library fund.

School Concessions

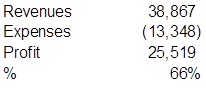

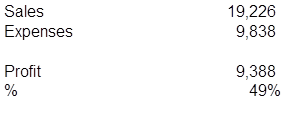

Concession includes the sales of food and drink items. Gross profit from concessions were computed as shown below:

At the end of the school year, $24,485 was transferred from concessions to the general fund.

Fixed Asset Inventory

To verify physical existence of items on the school inventory list, I randomly selected items from the inventory list and checked for their physical presence in the listed room. As I moved throughout the school, I also picked items from each room and then verified that the item was on the inventory list. I was able to locate inventory items with the assistance of school personnel. Of the 1,528 items contained on the school’s property inventory, I selected a sample of 276 (18%).

The following are items that were not located in the listed location on the inventory report:

One inventory item was purchased with student activity funds, a TruTouch interactive board. The asset was not on the inventory report.

Prior Examination Report Findings

The prior examination of Franklinton Primary School was for the period July 1, 2015, through June 30, 2016. There were not issues from this examination.

I was not engaged to, and did not, perform an audit, the objective of which would be the expression of an opinion on the specified elements, accounts, or items. Accordingly, I do not express such an opinion. Had I performed additional procedures, other matters might have come to my attention that would have been reported to you.

This report is intended solely for the use of the board and management of Washington Parish School Board, and is not intended to be and should not be used by anyone other than these specified parties. The purpose of this report is to describe the procedures performed for school and the results of those procedures. Accordingly, this report is not suitable for any other purpose. Under Louisiana Revised Statute 24:513, this report is distributed by the Louisiana Legislative Auditor as a public document.

Yours truly,

Minda B. Raybourn

Franklinton, LA

January 4, 2022

Corrective Action Plan for Franklinton Primary School

Cash Disbursements:

The principal will verify that each request for a check includes signed requisitions and purchase orders. The principal will also verify that purchase requisitions are completed prior to placing orders.

Fixed Assets:

When fixed asset inventory is moved from one location to another, the transfer will be documented and sent in to the Accountant II- Inventory Clerk at the Central Office.

Motion carried unanimously.

Agenda Item #9 – Discuss and take appropriate action regarding Independent Accountant’s report on applying agreed upon procedures Thomas Elementary School-Minda B. Rayburn, CPA, LLC(Lacy Burris).

It was moved by Dewitt Perry, seconded by Robert Boone, that the Board approve the Independent Accountant’s Report on Applying Agreed Upon Procedures – Thomas Elementary School as follows:

WASHINGTON PARISH SCHOOL BOARD

INDEPENDENT ACCOUNTANT’S REPORT ON

AGREED-UPON PROCEDURES

FOR

Thomas Elementary School

AS OF AND FOR THE PERIOD

July 1, 2020 through June 30, 2021

Minda B. Raybourn

Certified Public Accountant

Limited Liability Company

820 11th Avenue

Franklinton, Louisiana 70438

(985) 839-4413

Fax (985) 839-4402

WASHINGTON PARISH SCHOOL BOARD

INDEPENDENT ACCOUNTANT’S REPORT ON

APPLYING AGREED-UPON PROCEDURES

Washington Parish School Board

Franklinton, LA

I have performed the procedures listed below, which were agreed upon by the Washington Parish School Board and Superintendent. These procedures were performed solely to assist the school board management with respect to compliance with policy and procedures concerning individual school activity accounts and school property inventory at Thomas Elementary School for the period of July 1, 2020, through June 30, 2021. The school board’s management is responsible for the accounting and inventory records and for established policies and procedures over the student activity fund and school inventory. This engagement to apply agreed-upon procedures was performed in accordance with attestation standards established by the American Institute of Certified Public Accountants. The sufficiency of the procedures is solely the responsibility of the specified users of the report. Consequently, I make no representation regarding the sufficiency of the procedures described below either for the purpose for which this report has been requested or for any other purpose.

I tested inventory records to determine the physical existence of property as listed on the school’s property inventory report and to determine that property at the school was included on the inventory list. I also inspected property items to determine if they were identified as property of the school and numbered in accordance with the property inventory list. I examined the records for the school’s activity accounts. Three months of bank reconciliations were tested for completeness and mathematical accuracy. Disbursements were tested for proper use of requisitions, purchase orders and supporting documentation in relation to the school board policies and procedures. I tested bank deposits against pre-numbered receipts for propriety and traced them to the activity account ledger. I calculated gross profit percentages on concession sales and performed reasonableness tests on other receipt categories where applicable.

Bank reconciliations

Each month tested was mathematically correct, all reconciling items proper, and the reconciled balance equaled the activity account ledger. Beginning and ending balances were traced to prior and subsequent year balances to verify proper cutoffs with transactions recorded in the proper period and balances carried forward properly. Checks older than one year old totaled $482. The beginning bank balance at July 1, 2020, was $100,299, and the balance at June 30, 2021 was $92,356 resulting in a net decrease of $7,943 for the year ended.

Cash Disbursements

School board policy requires that a properly executed requisition and purchase order be issued prior to the purchase or order of goods and services. In addition, an itemized invoice or other detailed documentation should support the payment.

I tested 14 disbursements. Out of the 14 disbursements, all had a purchase requisition, purchase order, and invoice or receipt. Purchase requisitions and purchase orders were all approved. Payment documentation was approved. One disbursement had sales tax charged for $64.96.

All invoices tested appear to be on a current basis, and the disbursement records were neat and orderly allowing the verification process to be accomplished in an efficient manner.

Cash Receipts

For each transaction, a computer-generated receipt is required to be produced. A total of 15 items were examined. I found all receipts and related documentation. The items tested were coded accurately to the correct fund.

The receipts tested were balanced to the daily recap and traced to the appropriate account in the activity ledger. Deposit tickets were complete and agreed with the daily report. The funds appear to be deposited timely.

Fundraisers

The school had one book fair. Scholastic gives the school of two choices for profits 1) 50% of the sales can be good towards purchases from Scholastic or 2) the school can receive 25% of the profits. The book fair netted the school a profit of $997. Profits went to the library fund.

The total amount of the deposits from the book fair deposited in to the account were $8,181. The amount of deposits reported as sales to Scholastic were $4,489. There is a difference of $3,693. Because of the difference in the sales reported to Scholastic, the profit appears to be wrong. Based on the deposits, the 25% profit should have been $2,045.

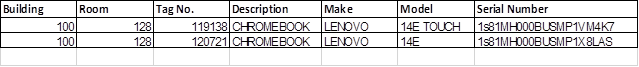

Thomas Elementary had two cookie dough fundraisers. One fundraiser was held in the fall semester and the second in the spring. Profits are as follow:

School Concessions

Concession includes the sales of food and drink items. Gross profit from concessions were computed as shown below:

Fixed Asset Inventory

To verify physical existence of items on the school inventory list, I randomly selected items from the inventory list and checked for their physical presence in the listed room. As I moved throughout the school, I also picked items from each room and then verified that the item was on the inventory list. I was able to locate inventory items with the assistance of school personnel. Of the 1,578 items contained on the school’s property inventory, I selected a sample of 271 (17%).

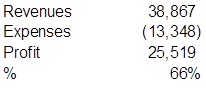

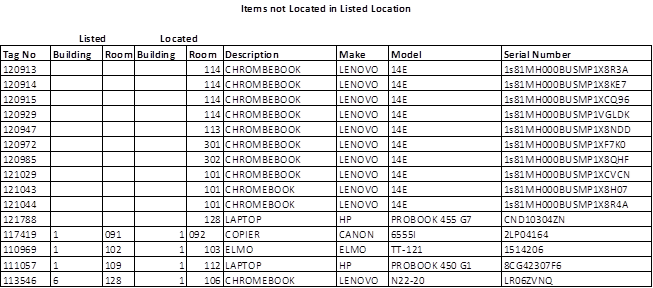

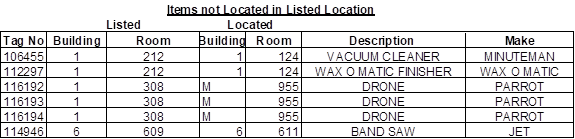

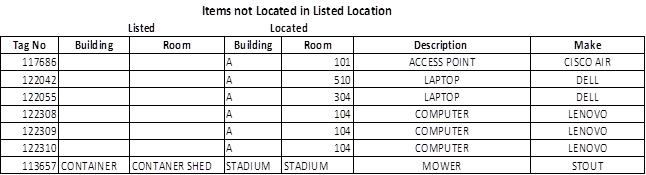

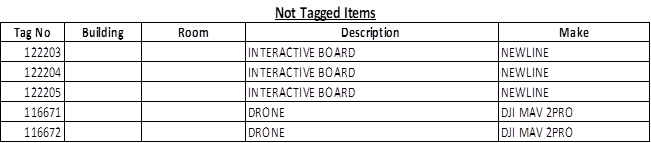

The following are items that were not located in the listed location on the inventory report:

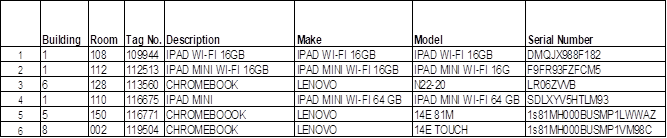

The following are items that could not be located:

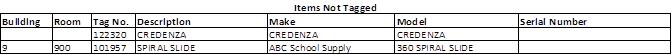

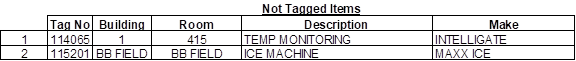

Below are items that were not tagged:

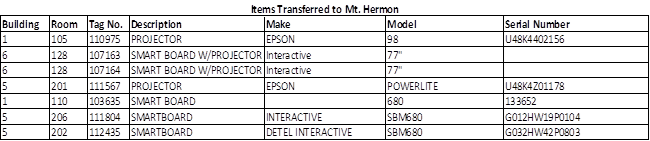

Below are items transferred to Mt. Hermon but are on Thomas Elementary’s report:

One inventory item was purchased with student activity funds, 4 TruTouch interactive boards. The assets are on the inventory report.

Prior Examination Report Findings

The prior examination of Thomas Elementary School was for the period July 1, 2015, through June 30, 2016. Issues of note:

Some of the disbursements tested had no purchase order.

Fundraising reports were not complete.

Concession gross profit percentage was 37%.

I was not engaged to, and did not, perform an audit, the objective of which would be the expression of an opinion on the specified elements, accounts, or items. Accordingly, I do not express such an opinion. Had I performed additional procedures, other matters might have come to my attention that would have been reported to you.

This report is intended solely for the use of the board and management of Washington Parish School Board, and is not intended to be and should not be used by anyone other than these specified parties. The purpose of this report is to describe the procedures performed for school and the results of those procedures. Accordingly, this report is not suitable for any other purpose. Under Louisiana Revised Statute 24:513, this report is distributed by the Louisiana Legislative Auditor as a public document.

Yours truly,

Minda B. Raybourn

Franklinton, LA

January 4, 2022

Corrective Action Plan for Thomas Elementary School

Bank Reconciliations:

The school will begin researching checks over 90 days old and taking appropriate action.

Cash Disbursements:

Invoices will be reviewed for sales taxes charged and they will be adjusted prior to payment.

Fundraisers:

Fundraiser reports will be verified for accuracy when completed.

School Concessions will be evaluated and prices/expenses will be adjusted in order to increase the gross profit percentage.

Fixed Assets:

When fixed asset inventory is moved from one location to another, the transfer will be documented and sent in to the Accountant II- Inventory Clerk at the Central Office. In addition, fixed assets will be closely monitored at the school and appropriate documentation will be sent in to the Accountant II- Inventory Clerk at the Central Office when items are disposed of. If a tag cannot be affixed to an item, the inventory number will be marked on the item with a marker. Purchases made with school activity funds will be closely monitored to determine if they should be tagged and added to inventory.

Motion carried unanimously.

Agenda Item #10 – Discuss and take appropriate action regarding Independent Accountant’s report on applying agreed upon procedures Franklinton High School-Minda B. Rayburn, CPA, LLC(Lacy Burris).

It was moved by Alan McCain, seconded by Dan Slocum, that the Board approve the Independent Accountant’s Report on Applying Agreed Upon Procedures – Franklinton High School as follows:

WASHINGTON PARISH SCHOOL BOARD

INDEPENDENT ACCOUNTANT’S REPORT ON

AGREED-UPON PROCEDURES

FOR

Franklinton High School

AS OF AND FOR THE PERIOD

July 1, 2020 through June 30, 2021

Minda B. Raybourn

Certified Public Accountant

Limited Liability Company

820 11th Avenue

Franklinton, Louisiana 70438

(985) 839-4413

Fax (985) 839-4402

WASHINGTON PARISH SCHOOL BOARD

INDEPENDENT ACCOUNTANT’S REPORT ON

APPLYING AGREED-UPON PROCEDURES

Washington Parish School Board

Franklinton, LA

I have performed the procedures listed below, which were agreed upon by the Washington Parish School Board and Superintendent. These procedures were performed solely to assist the school board management with respect to compliance with policy and procedures concerning individual school activity accounts and school property inventory at Franklinton High School for the period of July 1, 2020, through June 30, 2021. The school board’s management is responsible for the accounting and inventory records and for established policies and procedures over the student activity fund and school inventory. This engagement to apply agreed-upon procedures was performed in accordance with attestation standards established by the American Institute of Certified Public Accountants. The sufficiency of the procedures is solely the responsibility of the specified users of the report. Consequently, I make no representation regarding the sufficiency of the procedures described below either for the purpose for which this report has been requested or for any other purpose.

I tested inventory records to determine the physical existence of property as listed on the school’s property inventory report and to determine that property at the school was included on the inventory list. I also inspected property items to determine if they were identified as property of the school and numbered in accordance with the property inventory list. I examined the records for the school’s activity accounts. Three months of bank reconciliations were tested for completeness and mathematical accuracy. Disbursements were tested for proper use of requisitions, purchase orders and supporting documentation in relation to the school board policies and procedures. I tested bank deposits against pre-numbered receipts for propriety and traced them to the activity account ledger. I calculated gross profit percentages on concession sales and performed reasonableness tests on other receipt categories where applicable.

Bank reconciliations

Each month tested was mathematically correct, all reconciling items proper, and the reconciled balance equaled the activity account ledger. Beginning and ending balances were traced to prior and subsequent year balances to verify proper cutoffs with transactions recorded in the proper period and balances carried forward properly. At June 30, 2021, there was $900 in outstanding checks that were one year and older. The beginning bank balance at July 1,

2020, was $216,832, and the balance at June 30, 2021 was $245,257, resulting in a net increase of $28,425 for the year ended.

Cash Disbursements

School board policy requires that a properly executed requisition and purchase order be issued prior to the purchase or order of goods and services. In addition, an itemized invoice or other detailed documentation should support the payment.

I tested 34 disbursements. Out of the 34 disbursements, all had a purchase requisition, purchase order, and invoice or receipt. Purchase requisitions and purchase orders were all approved. Payment documentation was approved.

All invoices tested appear to be on a current basis, and the disbursement records were neat and orderly allowing the verification process to be accomplished in an efficient manner.

Cash Receipts

For each transaction, a computer-generated receipt is required to be produced. A total of 20 items were examined. I found all receipts and related documentation. The items tested were coded accurately to the correct fund.

The receipts tested were balanced to the daily recap and traced to the appropriate account in the activity ledger. Deposit tickets were complete and agreed with the daily report. The funds appear to be deposited timely.

Fundraisers

One of the school’s biggest fundraisers was the Krispy Kreme Donut fundraiser for the Beta club. Below are results:

Athletic Events

Ticket reconciliation forms are required to be completed and signed after reach event. The form requires that the number of tickets sold, ticket prices, and gate proceeds be computed. A cash reconciliation is also required to be computed to reconcile the gate and start-up funds. Three signatures are required on the form.

Testing revealed a consistent use of the form. Beginning and ending ticket numbers along with ticket prices were calculated along with the gate proceeds and advance money. Proceeds were traced from the reconciliation forms to the accounting records.

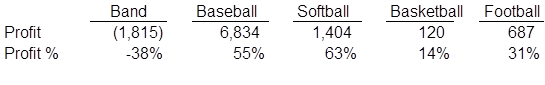

Athletic Concessions

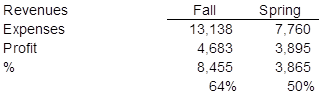

For the band boosters and ball teams, sales and supply cost data to compute the gross profit on each concession were extracted from the school accounting records. I computed the gross profit (percentage and dollar) for each area as follows:

Reconciliation forms are required to account for the concession proceeds. All forms were obtained and accounted for.

School Concessions

Drink and snack concession profits support the school’s technology initiatives. The gross profit generated for the school year was $16,843 and the gross profit percentage was 46%.

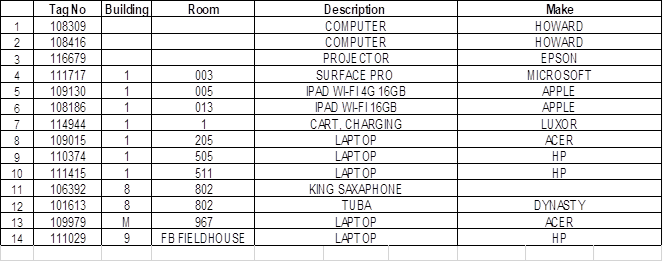

Fixed Asset Inventory

To verify physical existence of items on the school inventory list, I randomly selected items from the inventory list and checked for their physical presence in the listed room. As I moved throughout the school, I also picked items from each room and then verified that the item was on the inventory list. I was able to locate inventory items with the assistance of school personnel. Of the 2,137 items contained on the school’s property inventory, I selected a sample of 300 (14%).

Due to COVID-19 and distance learning, the school provides Chromebooks for students to use. We found that 53 Chromebooks were checked out to students.

The school has a tracking system in place as to what student has which Chromebook.

The following are items not located in the listed location on the inventory report:

The following are items that did not have an identifiable tag number:

Thirteen new computers were purchased using student account activity funds. These items are on the inventory listing as items 121509 through 121521.

The following are items that could not be located:

Prior Examination Report Findings

The prior examination of Franklinton High School was for the period July 1, 2016, through June 30, 2017. Areas of note on this examination are as follows:

Three disbursements had an invoice dated prior to the requisition and purchase order.

Fundraisers are required to have financial reports submitted to central office after the fundraiser is concluded. Three fundraisers did not have financial reports.

Checks older than one year outstanding totaled $7,867.

I was not engaged to, and did not, perform an audit, the objective of which would be the expression of an opinion on the specified elements, accounts, or items. Accordingly, I do not express such an opinion. Had I performed additional procedures, other matters might have come to my attention that would have been reported to you.

This report is intended solely for the use of the board and management of Washington Parish School Board, and is not intended to be and should not be used by anyone other than these specified parties. The purpose of this report is to describe the procedures performed for school and the results of those procedures. Accordingly, this report is not suitable for any other purpose. Under Louisiana Revised Statute 24:513, this report is distributed by the Louisiana Legislative Auditor as a public document.

Yours truly,

Minda B. Raybourn

Franklinton, LA

January 4, 2022

Corrective Action Plan for Franklinton High School

Concessions:

The Band’s main fundraiser did not take place in 2020 due to the cancellation of the Washington Parish Free Fair. Other concessions were also lower than normal due to limited capacity due to COVID.

Fixed Assets:

When fixed asset inventory is moved from one location to another, the transfer will be documented and sent in to the Accountant II- Inventory Clerk at the Central Office. In addition, fixed assets will be closely monitored at the school and appropriate documentation will be sent in to the Accountant II- Inventory Clerk at the Central Office when items are disposed of. In addition, if a tag cannot be affixed to an item, the inventory number will be marked on the item with a marker.

Motion carried unanimously.

Agenda Item #11 - Discuss and take appropriate action regarding Independent Accountant’s report on applying agreed upon procedures Pine High School-Minda B. Rayburn, CPA, LLC(Lacy Burris).

It was moved by Kendall McKenzie, seconded by Robert Boone, that the Board approve the Independent Accountant’s Report on Applying Agreed Upon Procedures – Pine High School as follows:

WASHINGTON PARISH SCHOOL BOARD

INDEPENDENT ACCOUNTANT’S REPORT ON

AGREED-UPON PROCEDURES

FOR

Pine High School

AS OF AND FOR THE PERIOD

July 1, 2020 through June 30, 2021

Minda B. Raybourn

Certified Public Accountant

Limited Liability Company

820 11th Avenue

Franklinton, Louisiana 70438

(985) 839-4413

Fax (985) 839-4402

WASHINGTON PARISH SCHOOL BOARD

INDEPENDENT ACCOUNTANT’S REPORT ON

APPLYING AGREED-UPON PROCEDURES

Washington Parish School Board

Franklinton, LA

I have performed the procedures listed below, which were agreed upon by the Washington Parish School Board and Superintendent. These procedures were performed solely to assist the school board management with respect to compliance with policy and procedures concerning individual school activity accounts and school property inventory at Pine High School for the period of July 1, 2020, through June 30, 2021. The school board’s management is responsible for the accounting and inventory records and for established policies and procedures over the student activity fund and school inventory. This engagement to apply agreed-upon procedures was performed in accordance with attestation standards established by the American Institute of Certified Public Accountants. The sufficiency of the procedures is solely the responsibility of the specified users of the report. Consequently, I make no representation regarding the sufficiency of the procedures described below either for the purpose for which this report has been requested or for any other purpose.

I tested inventory records to determine the physical existence of property as listed on the school’s property inventory report and to determine that property at the school was included on the inventory list. I also inspected property items to determine if they were identified as property of the school and numbered in accordance with the property inventory list. I examined the records for the school’s activity accounts. Three months of bank reconciliations were tested for completeness and mathematical accuracy. Disbursements were tested for proper use of requisitions, purchase orders and supporting documentation in relation to the school board policies and procedures. I tested bank deposits against pre-numbered receipts for propriety and traced them to the activity account ledger. I calculated gross profit percentages on concession sales and performed reasonableness tests on other receipt categories where applicable.

Bank reconciliations

Each month tested was mathematically correct, all reconciling items proper, and the reconciled balance equaled the activity account ledger. Beginning and ending balances were traced to prior and subsequent year balances to verify proper cutoffs with transactions recorded in the proper period and balances carried forward properly. At June 30, 2021, there was $5,019 in outstanding checks that were 90 days and older. The beginning bank balance at July 1, 2020, was $174,300 and the balance at June 30, 2021 was $184,927, resulting in a net increase of $10,627 for the year ended.

Cash Disbursements

School board policy requires that a properly executed requisition and purchase order be issued prior to the purchase or order of goods and services. In addition, an itemized invoice or other detailed documentation should support the payment.

I tested 25 disbursements. Out of the 25 disbursements, all but one disbursement had a purchase requisition, purchase order, and invoice or receipt. The check was for $12.00. Purchase requisitions and purchase orders were all approved. Payment documentation was approved.

All invoices tested appear to be on a current basis, and the disbursement records were neat and orderly allowing the verification process to be accomplished in an efficient manner.

Cash Receipts

For each transaction, a computer-generated receipt is required to be produced. A total of 20 items were examined. I found all receipts and related documentation. The items tested were coded accurately to the correct fund.

The receipts tested were balanced to the daily recap and traced to the appropriate account in the activity ledger. Deposit tickets were complete and agreed with the daily report. The funds appear to be deposited timely.

Athletic Events

Ticket reconciliation forms are required to be completed and signed after reach event. The form requires that the number of tickets sold, ticket prices, and gate proceeds be computed. A cash reconciliation is also required to be computed to reconcile the gate and start-up funds. Three signatures are required on the form.

Testing revealed an inconsistent use of the form. Some forms were present for football games and some were not in the school’s records. All other ball teams had reconciliation forms.

Athletic Concessions

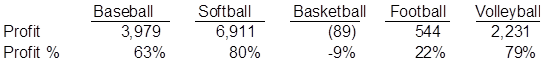

For the band boosters and ball teams, sales and supply cost data to compute the gross profit on each concession were extracted from the school accounting records. I computed the gross profit (percentage and dollar) for each area as follows:

Reconciliation forms are required to account for the concession proceeds. Some reconciliation forms were present and others not. One form for concessions for a softball game was not in the files. Football concessions appear to be posted to the volleyball account.

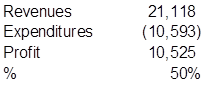

School Concessions

Drink and snack concession profits support the school’s general operations. Below is a chart that shows the profits and percentage of the concessions:

The reports showed on July 1, 2020, $10,468 was transferred on July 1, 2020 to the general fund. This appears to be for the 2019-2020 profit.

Fixed Asset Inventory

To verify physical existence of items on the school inventory list, I randomly selected items from the inventory list and checked for their physical presence in the listed room. As I moved throughout the school, I also picked items from each room and then verified that the item was on the inventory list. I was able to locate inventory items with the assistance of school personnel. Of the 1,804 items contained on the school’s property inventory, I selected a sample of 235 (13%). All of the 235 sampled were located.

Due to COVID-19 and distance learning, the school provides Chromebooks for students to use. We found that 84 Chromebooks were checked out to students. The school has a tracking system in place as to what student has which Chromebook.

The following are items not located in the listed location on the inventory report:

The following are items that were on the inventory report and were located but are to be discarded:

|

Items Discharged |

||||

|

Tag No |

Building |

Room |

Description |

Make |

|

110562 |

A |

105 |

COMPUTER |

HOWARD |

|

110574 |

A |

208 |

COMPUTER |

HOWARD |

|

110945 |

A |

208 |

COMPUTER |

HOWARD |

|

110568 |

A |

301 |

COMPUTER |

HOWARD |

|

112957 |

A |

303 |

ACTIVBOARD TOUCH |

PROMETHEAN |

|

117044 |

A |

304 |

PROMETHEAN BOARD |

ACTIVBOARD TOUCH |

|

109230 |

A |

401 |

COMPUTER |

HOWARD |

|

109228 |

JH FH |

JH FH |

COMPUTER |

HOWARD |

|

29263 |

OD |

UNDER STADIUM |

MOWER |

WOODS |

The following are items that did not have an identifiable tag number:

I was not engaged to, and did not, perform an audit, the objective of which would be the expression of an opinion on the specified elements, accounts, or items. Accordingly, I do not express such an opinion. Had I performed additional procedures, other matters might have come to my attention that would have been reported to you.

This report is intended solely for the use of the board and management of Washington Parish School Board, and is not intended to be and should not be used by anyone other than these specified parties. The purpose of this report is to describe the procedures performed for school and the results of those procedures. Accordingly, this report is not suitable for any other purpose. Under Louisiana Revised Statute 24:513, this report is distributed by the Louisiana Legislative Auditor as a public document.

Yours truly,

Minda B. Raybourn

Franklinton, LA

January 12, 2022

Corrective Action Plan for Pine HIgh School

Bank Reconciliations:

The school will begin researching checks over 90 days old and taking appropriate action.

Cash Disbursements:

Proper documentation will be maintained for all checks.

Athletic Events:

Ticket reconciliation reports were not used for ticket presales due to COVID. Ticket reconciliation forms will be used for all ticket sales.

Athletic Concessions:

Athletic concessions for football and basketball were not at their usual level due to COVID capacity restrictions at these events.

Fixed Assets:

When fixed asset inventory is moved from one location to another, the transfer will be documented and sent in to the Accountant II- Inventory Clerk at the Central Office. In addition, fixed assets will be closely monitored at the school and appropriate documentation will be sent in to the Accountant II- Inventory Clerk at the Central Office when items are disposed of. If a tag cannot be affixed to an item, the inventory number will be marked on the item with a marker.

Motion carried unanimously.

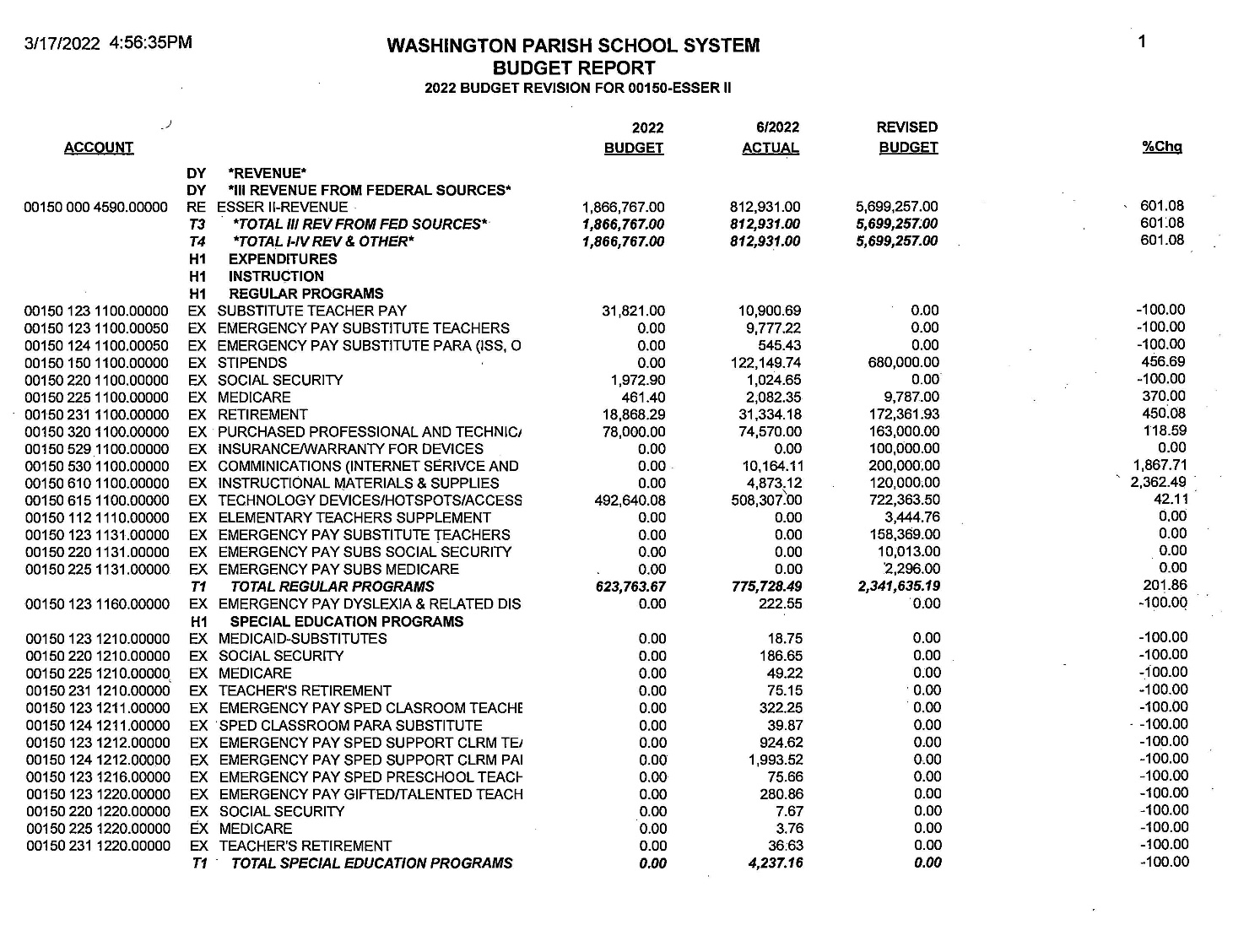

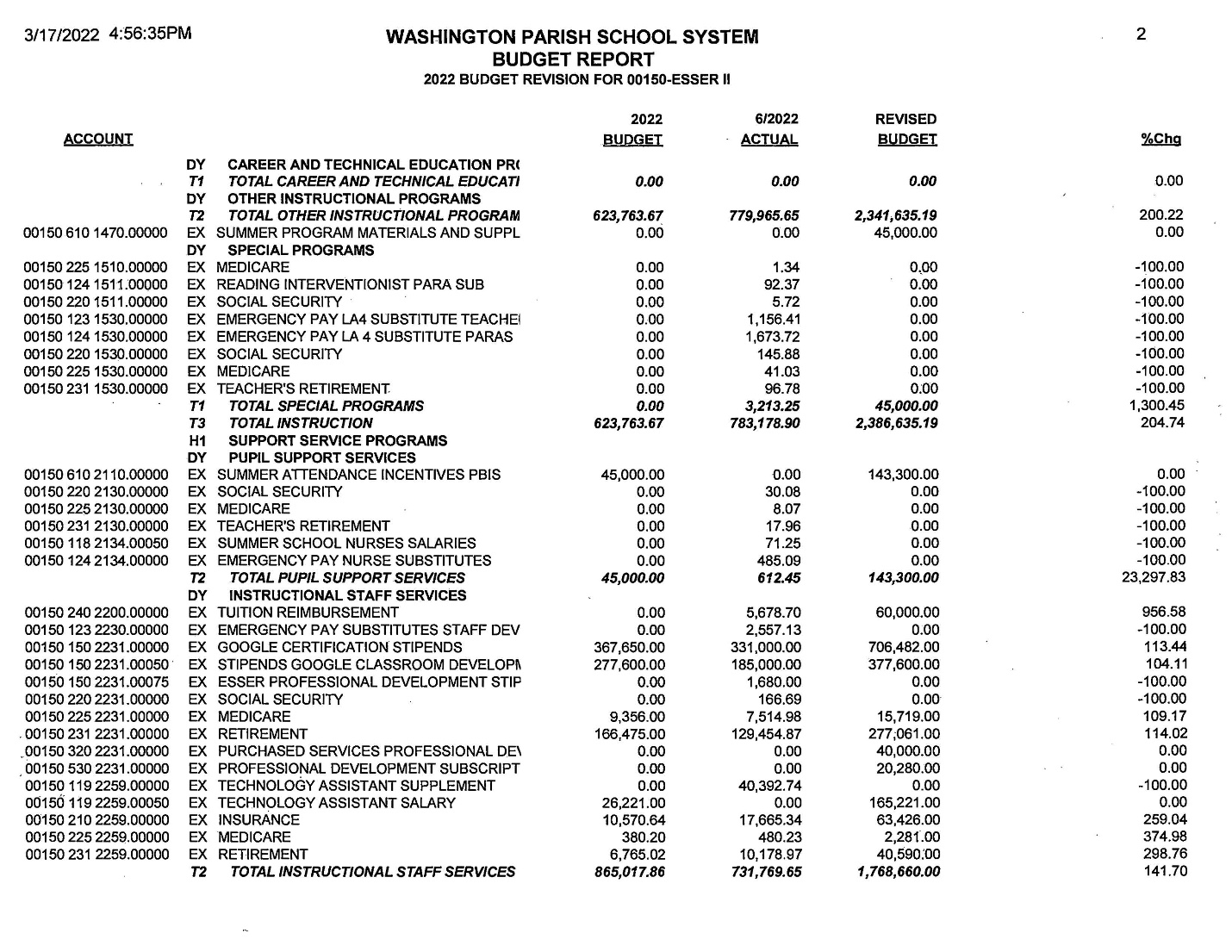

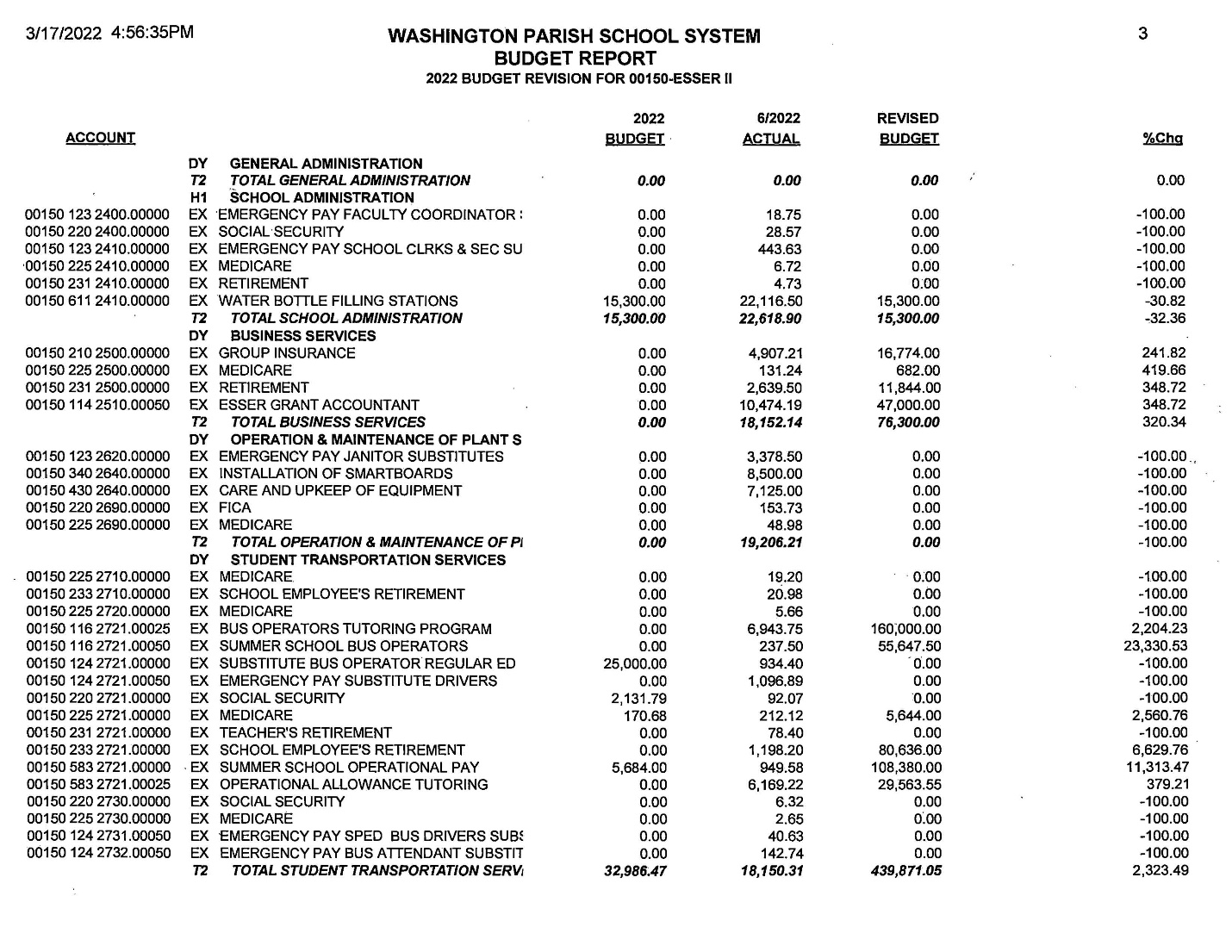

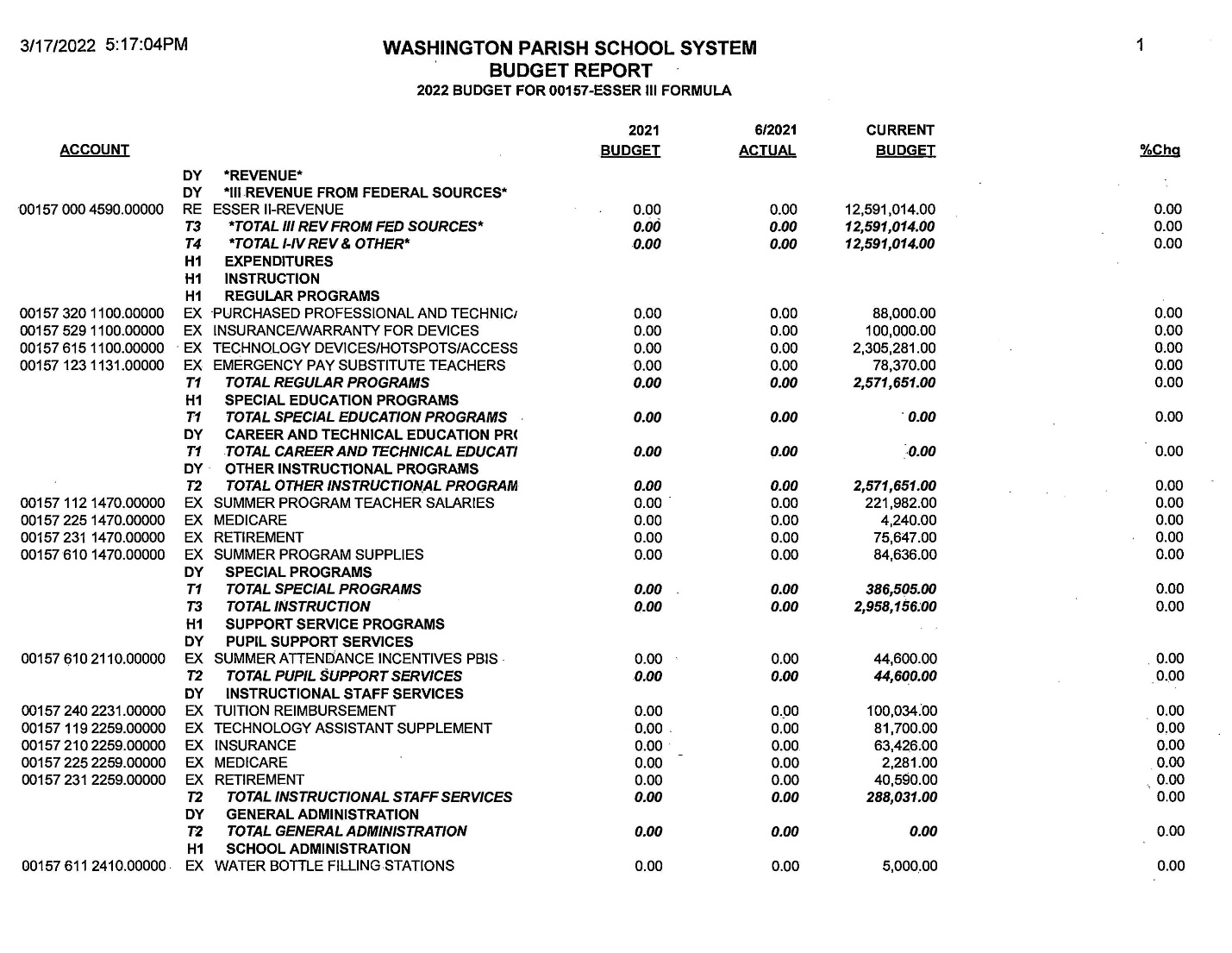

Agenda Item #12 –Consider a motion to adopt a budget revision for the ESSER II Formula Budget for the 2021/2022 fiscal year (Lacy Burris).

It was moved by Dewitt Perry, seconded by Alan McCain that the Board approve the budget revision for the ESSER II Formula Budget for the 2021/2022 fiscal year as follows:

Motion carried unanimously.

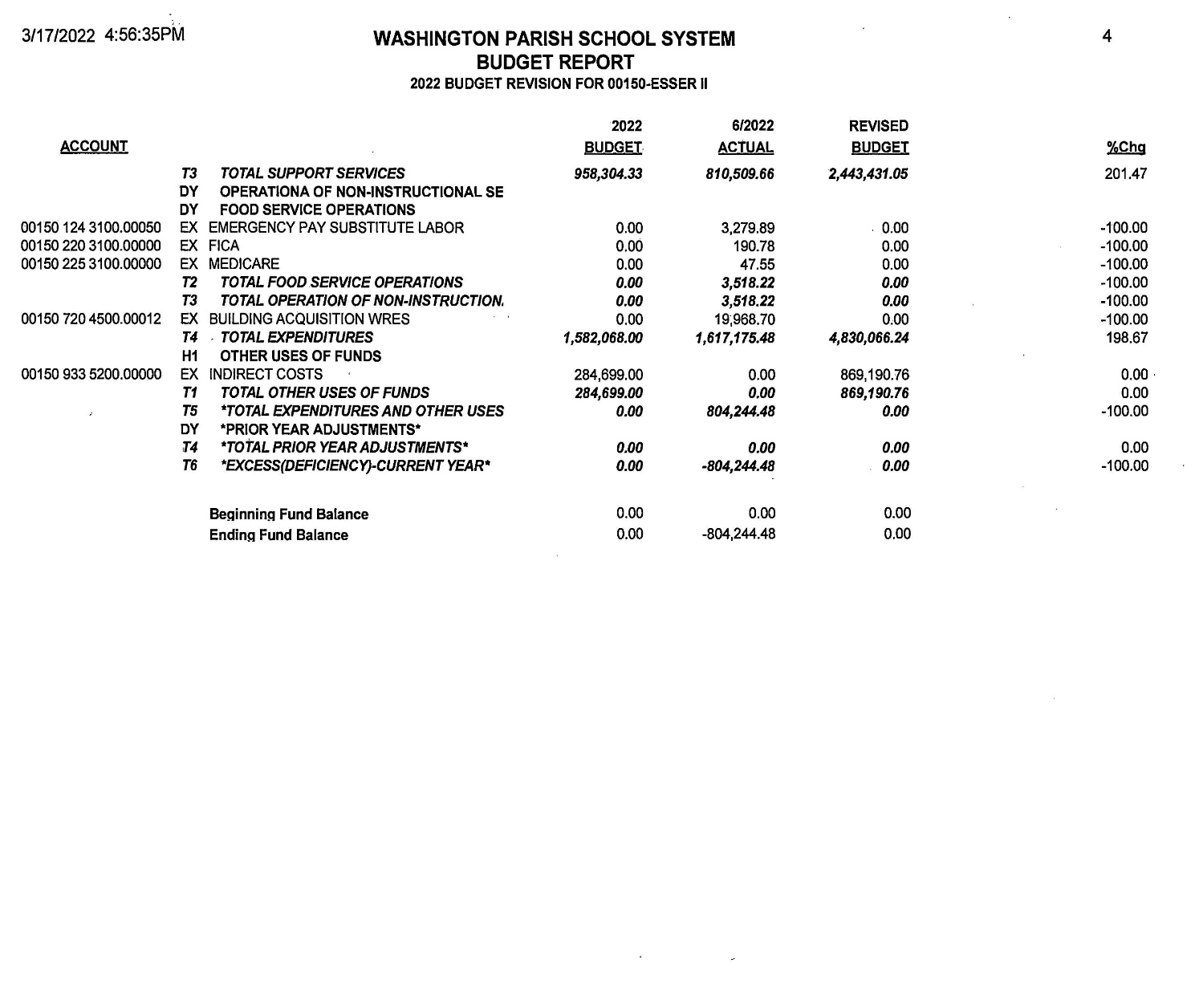

Agenda Item #13 - Consider a motion to adopt the ESSER_ II _Incentive Budget for the 2021/2022 fiscal year (Lacy Burris).

It was moved by Robert Boone, seconded by Frankie Crosby that the Board approve the ESSER_ II_Incentive Budget for the 2021/2022 fiscal year as follows:

Motion carried unanimously.

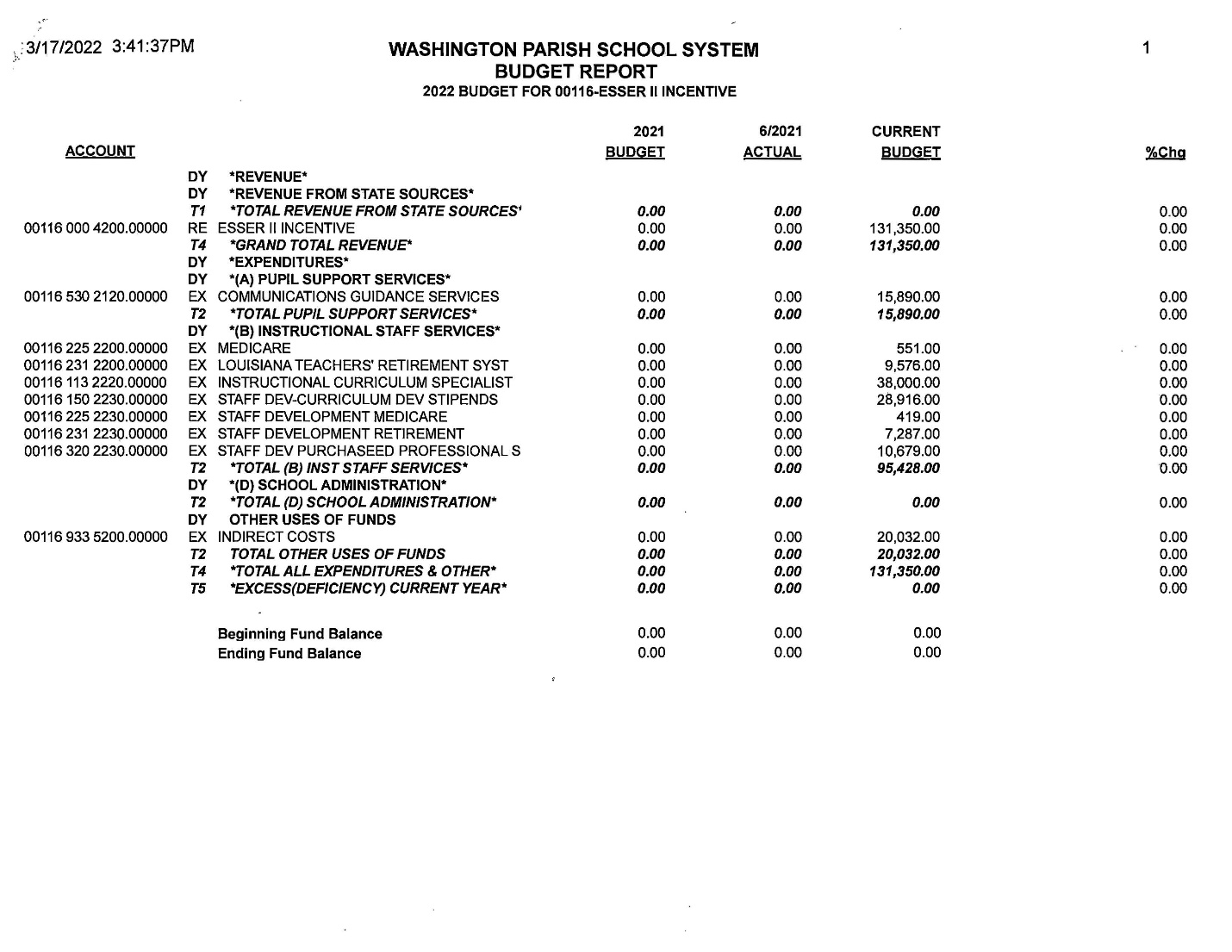

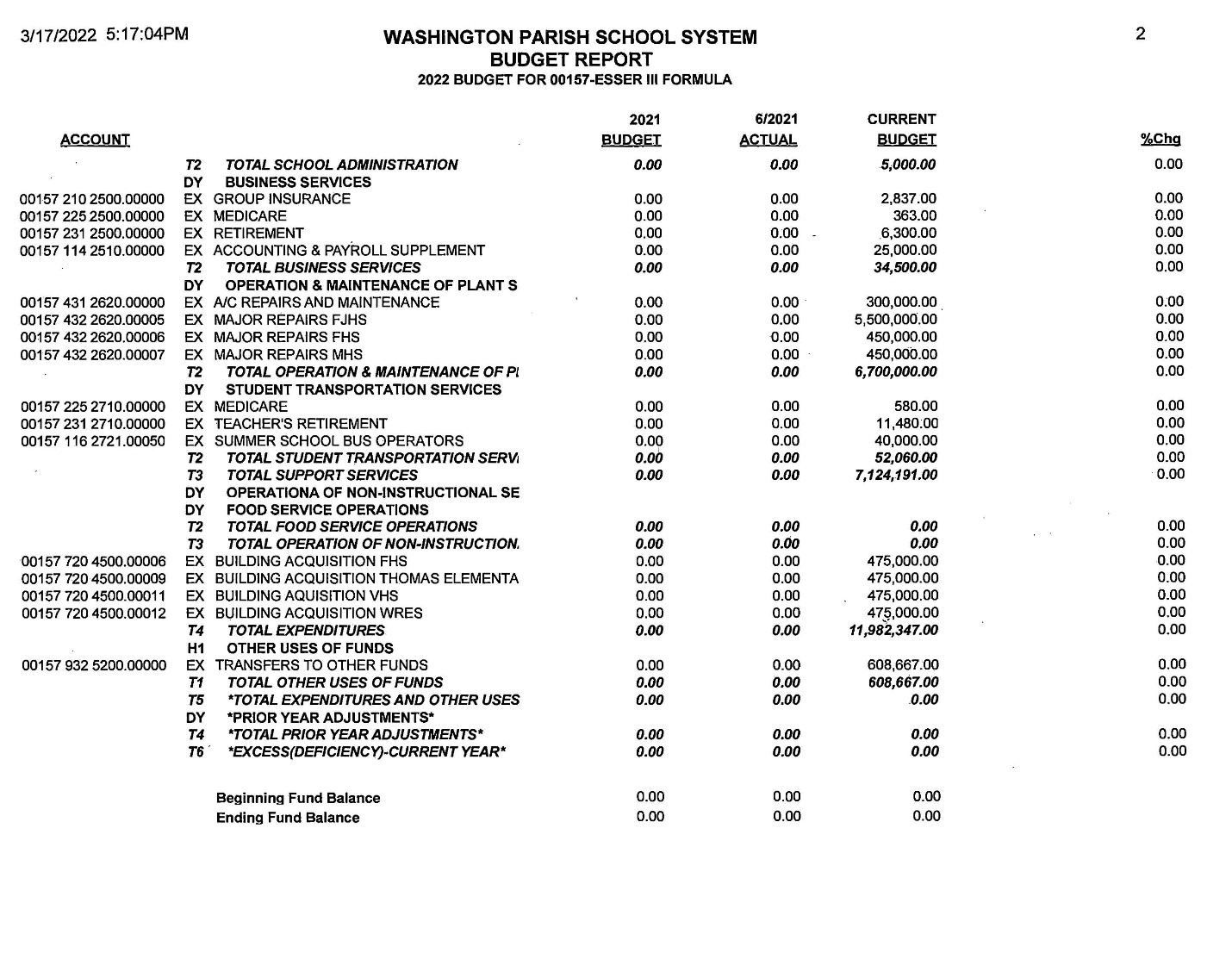

Agenda Item #14 - Consider a motion to adopt the ESSER_ III _Formula Budget for the 2021/2022 fiscal year (Lacy Burris)

It was moved by Dewitt Perry, seconded by Kendall McKenzie that the Board approve the ESSER_ III_Formula Budget for the 2021/2022 fiscal year as follows:

Motion carried unanimously.

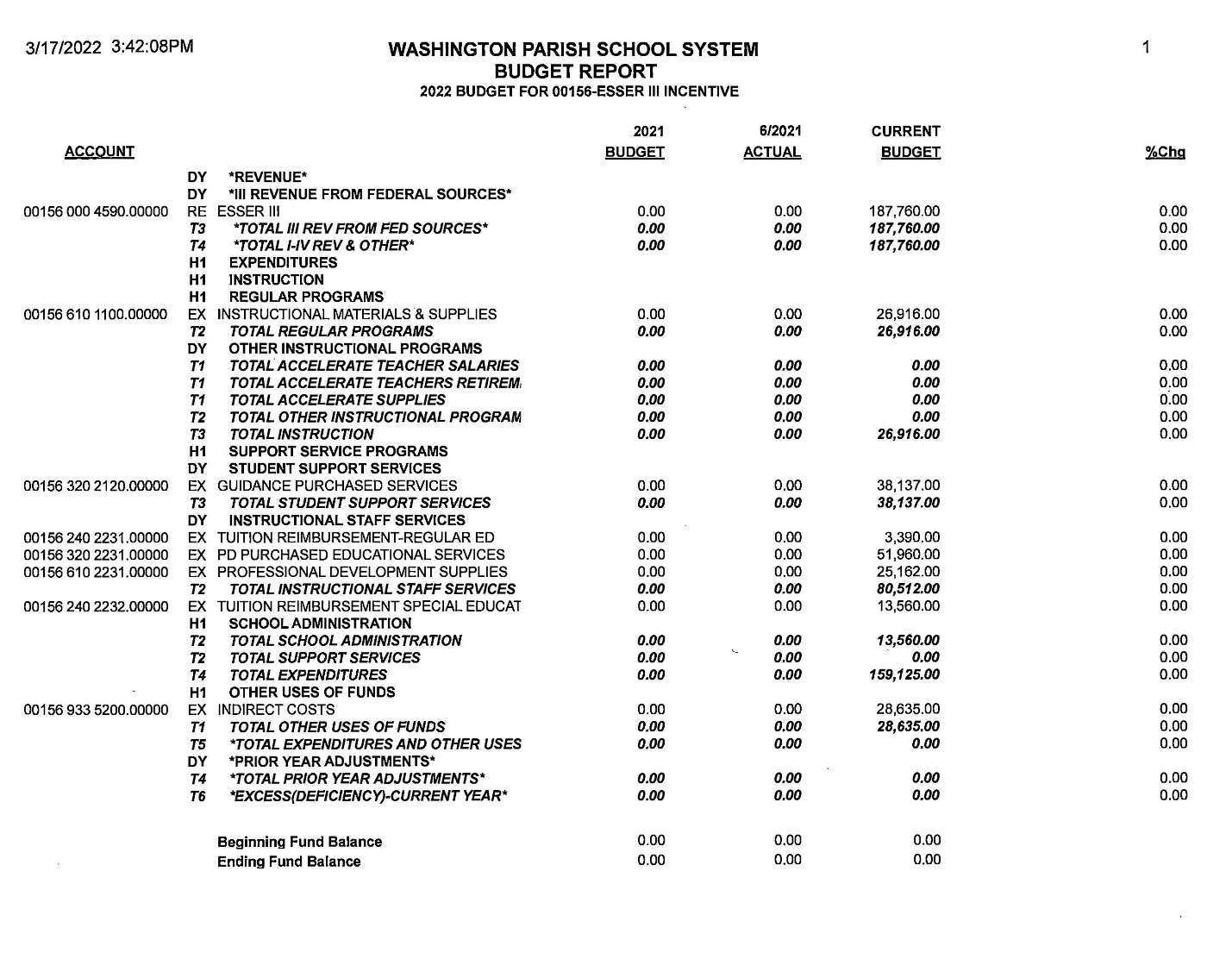

Agenda Item #15 - Consider a motion to adopt the ESSER_ III _Incentive Budget for the 2021/2022 fiscal year (Lacy Burris).

It was moved by Dewitt Perry, seconded by Alan McCain that the Board approve the ESSER_ III_Incentive Budget for the 2021/2022 fiscal year as follows:

Motion carried unanimously.

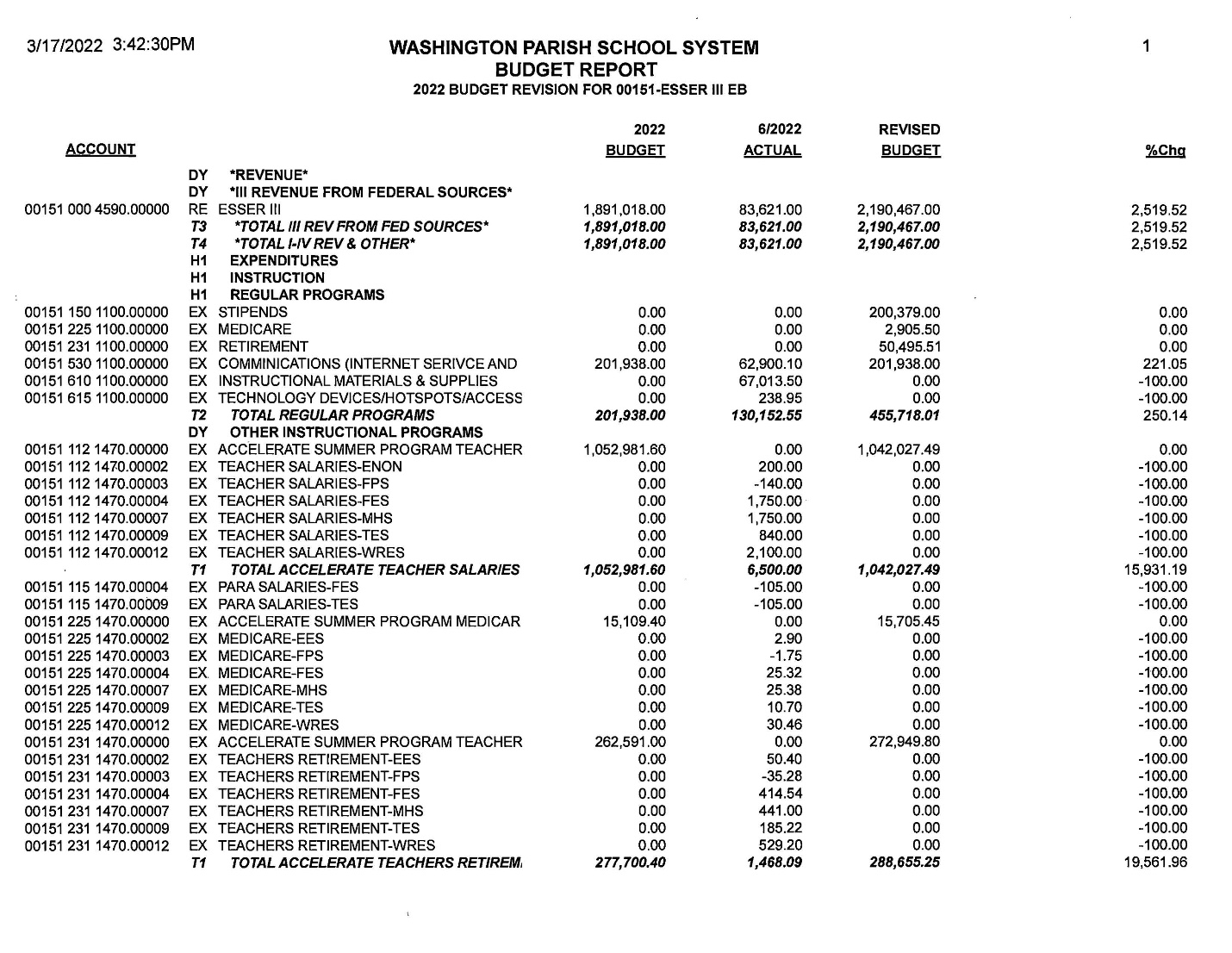

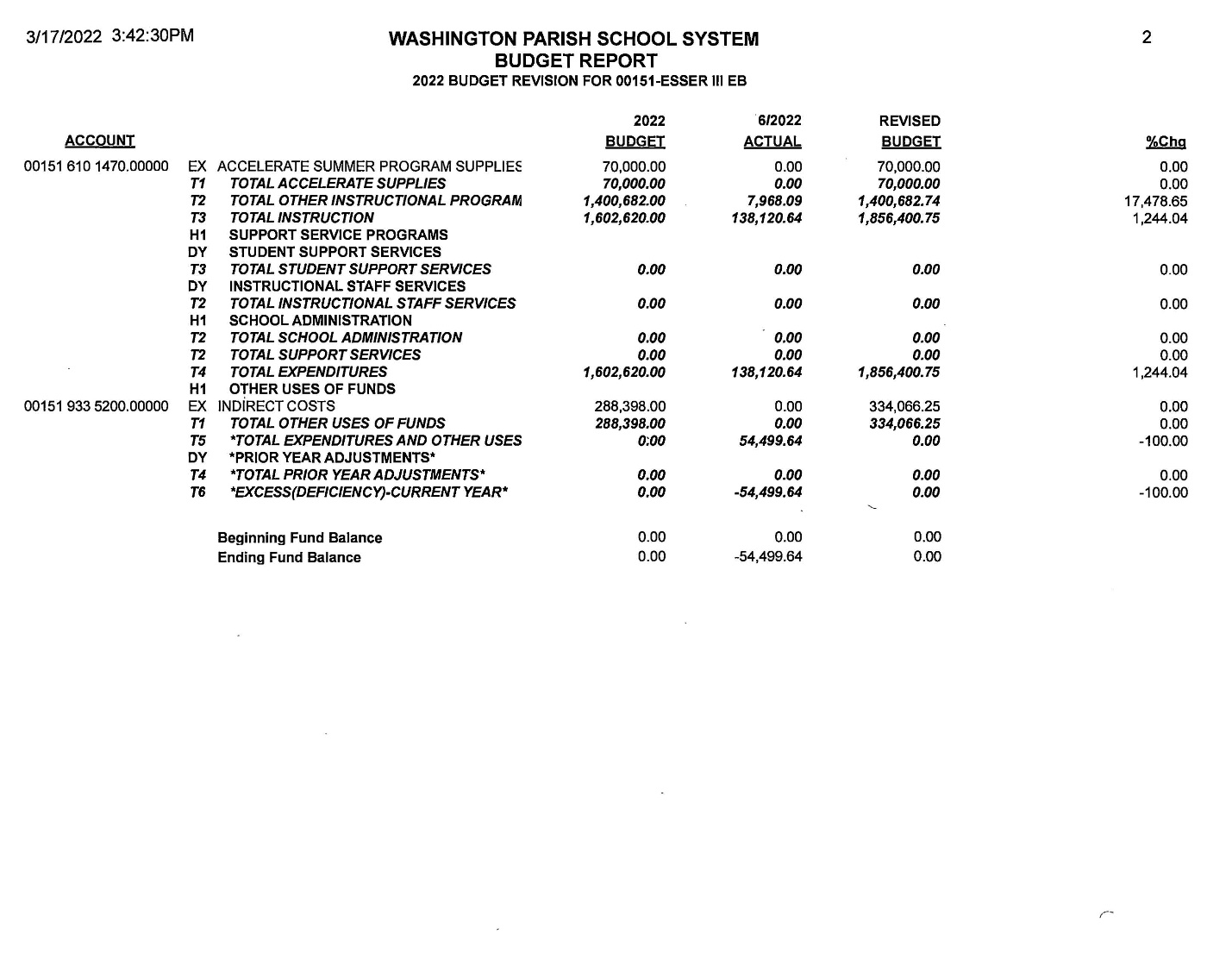

Agenda Item #16 - Consider a motion to adopt a budget revision for the ESSER_ IIIEB _Interventions Budget for the 2021/2022 fiscal year (Lacy Burris).

It was moved by Dewitt Perry, seconded by Alan McCain that the Board approve the budget revision for the ESSER_ IIIEB_ Interventions Budget for the 2021/2022 fiscal year as follows:

Motion carried unanimously.

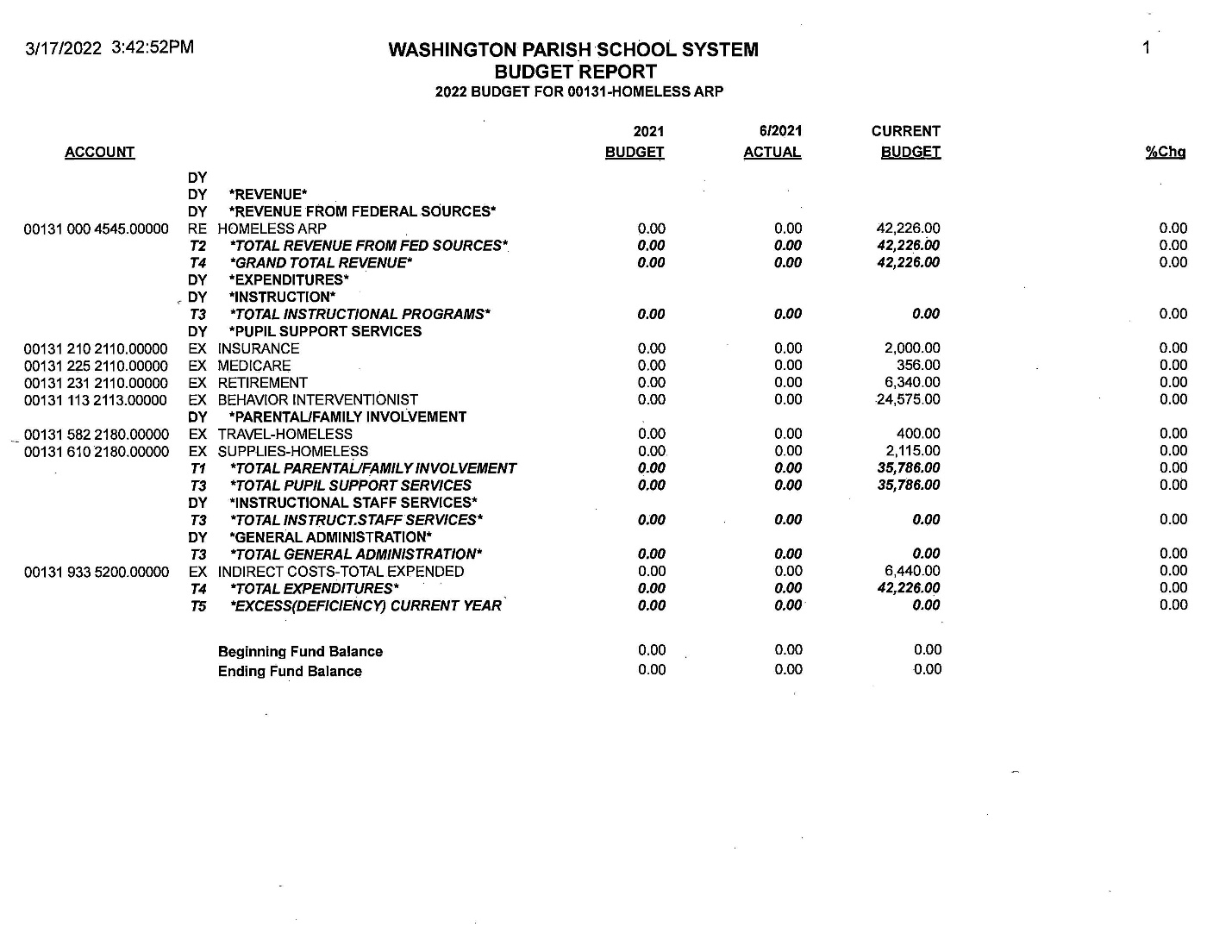

Agenda Item #17 - Consider a motion to adopt the Homeless_ARP Budget for the 2021/2022 fiscal year (Lacy Burris).

It was moved by Kendall McKenzie, seconded by Lesley McKinley that the Board approve the Homeless_ARP Budget for the 2021/2022 fiscal year as follows:

Motion carried unanimously.

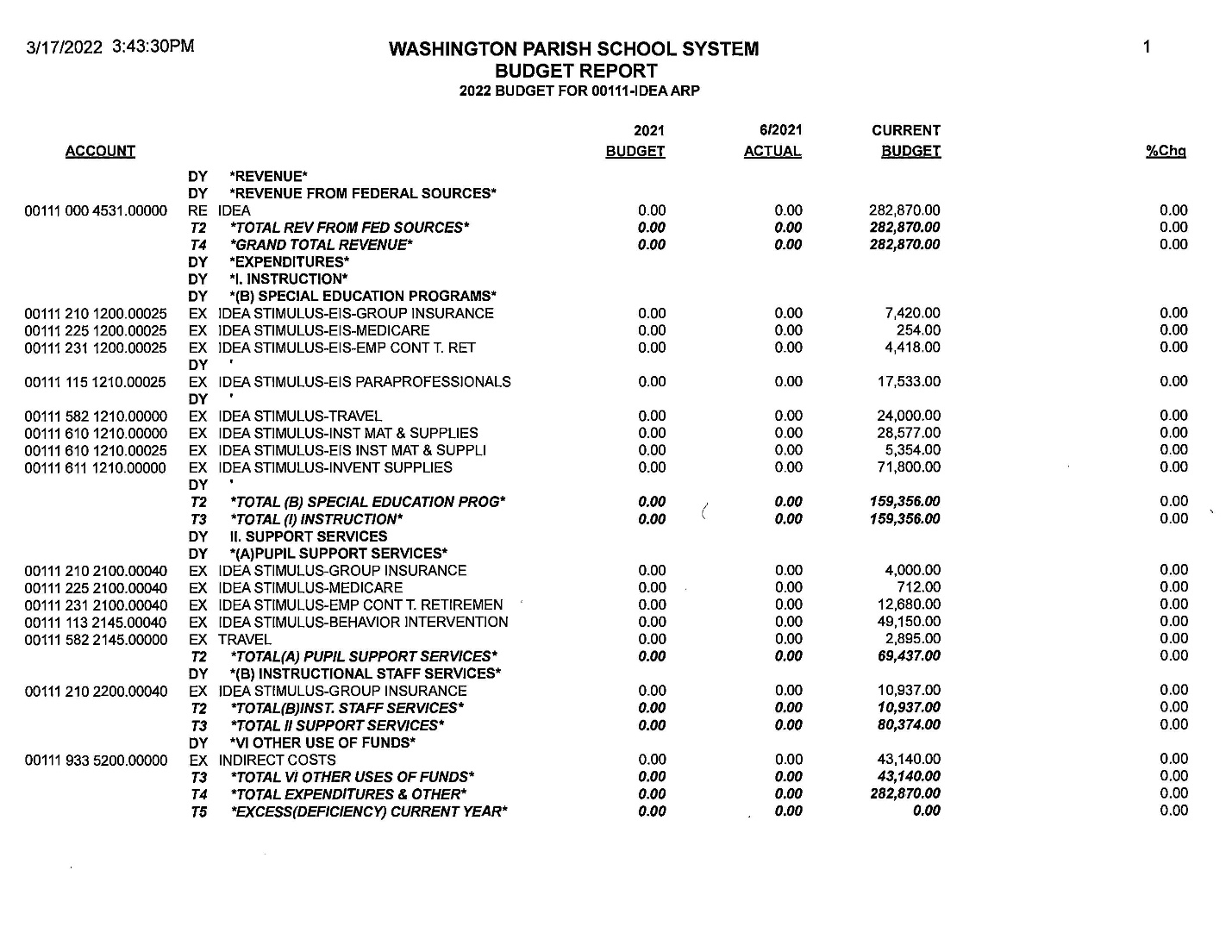

Agenda Item #18 - Consider a motion to adopt the IDEA_611_ARP Budget for the 2021/2022 fiscal year (Lacy Burris).

It was moved by Dan Slocum, seconded by Dewitt Perry that the Board approve the IDEA_611_ARP Budget for the 2021/2022 fiscal year as follows:

Motion carried unanimously.

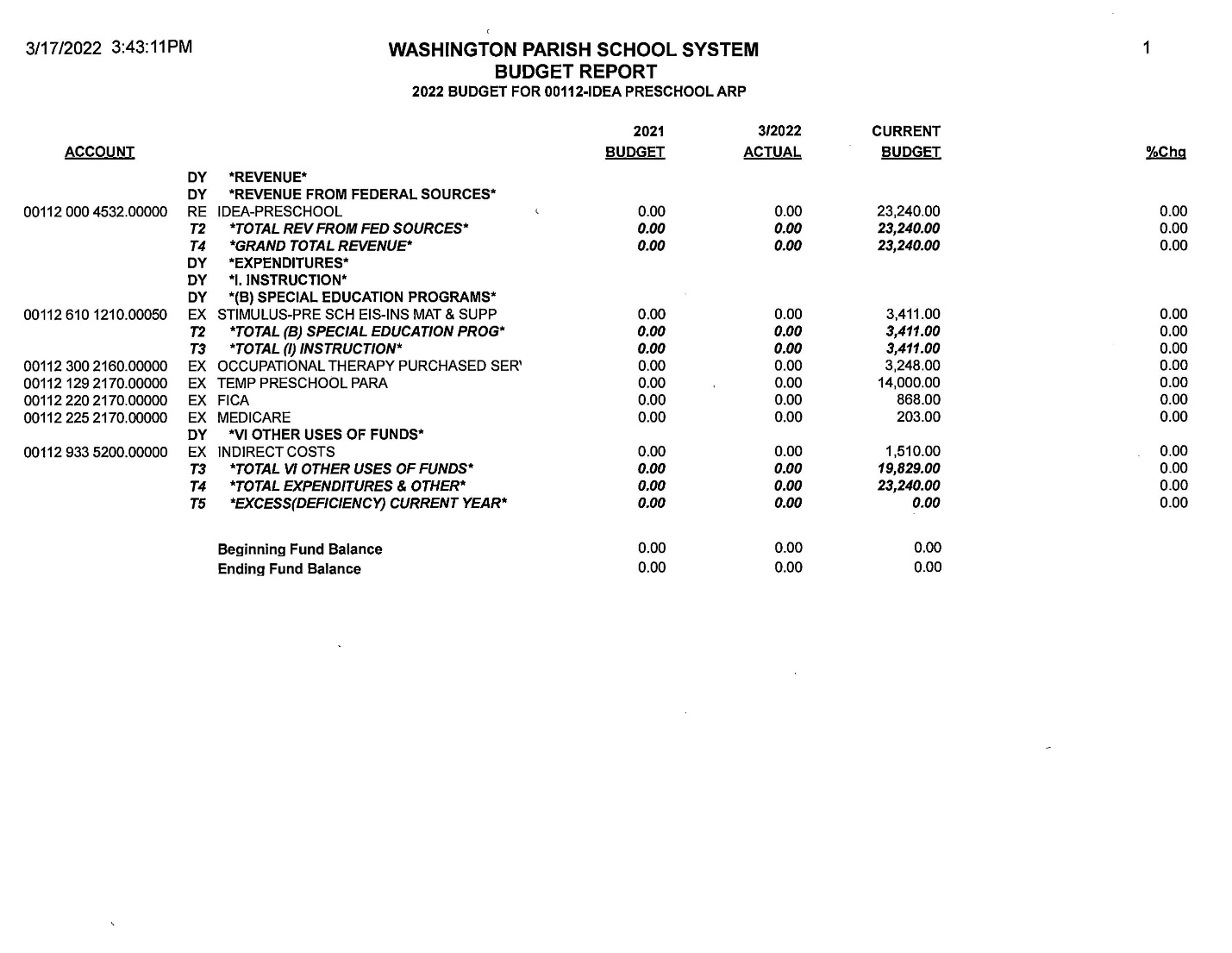

Agenda Item #19 - Consider a motion to adopt the IDEA_619_ARP Budget for the 2021/2022 fiscal year (Lacy Burris).

It was moved by Lesley McKinley, seconded by Alan McCain that the Board approve the IDEA_619_ARP Budget for the 2021/2022 fiscal year as follows:

Motion carried unanimously.

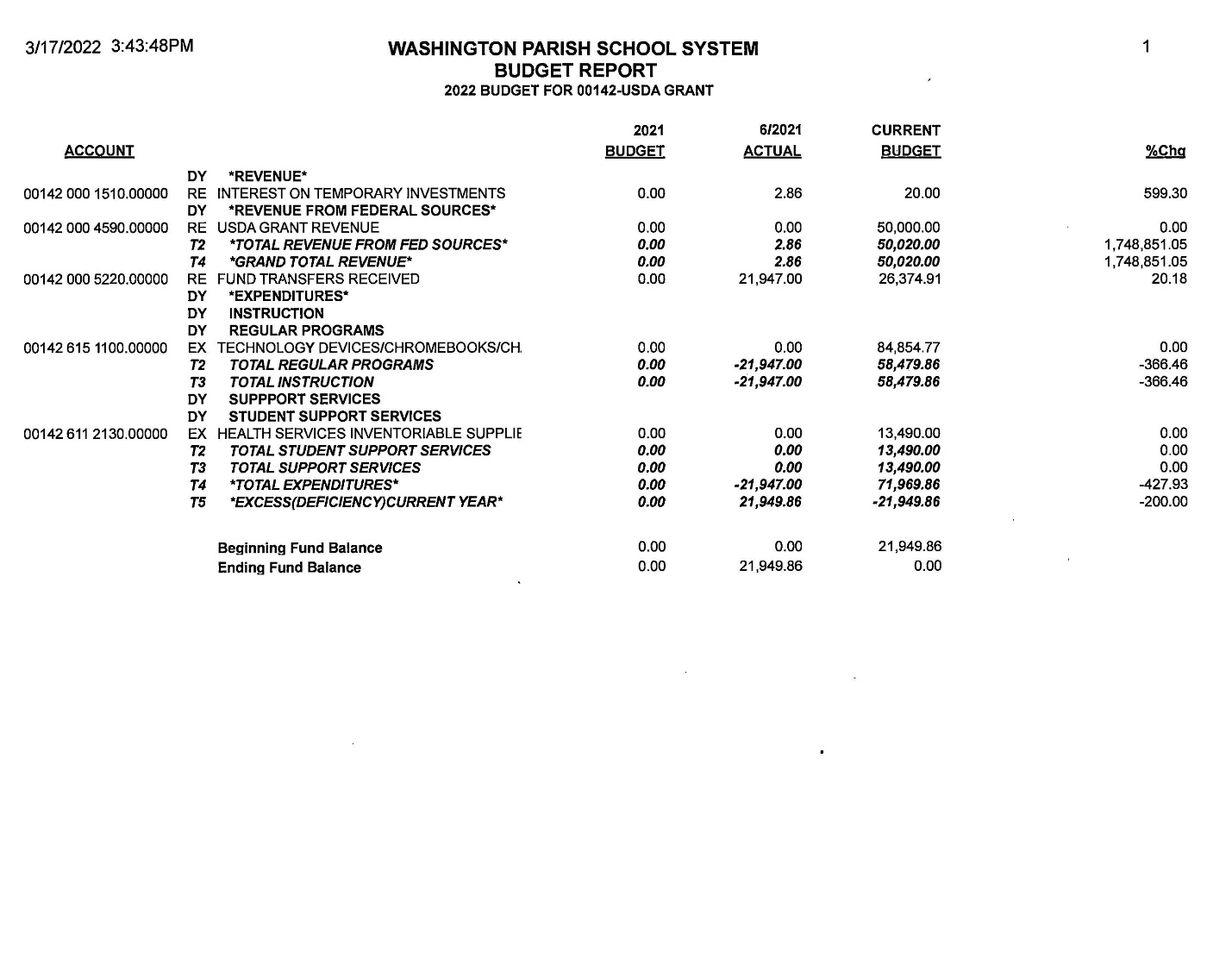

Agenda Item #20 - Consider a motion to adopt the USDA Budget for the 2021/2022 fiscal year (Lacy Burris).

It was moved by Dewitt Perry, seconded by Alan McCain that the Board approve the USDA Budget for the 2021/2022 fiscal year as follows:

Motion carried unanimously.

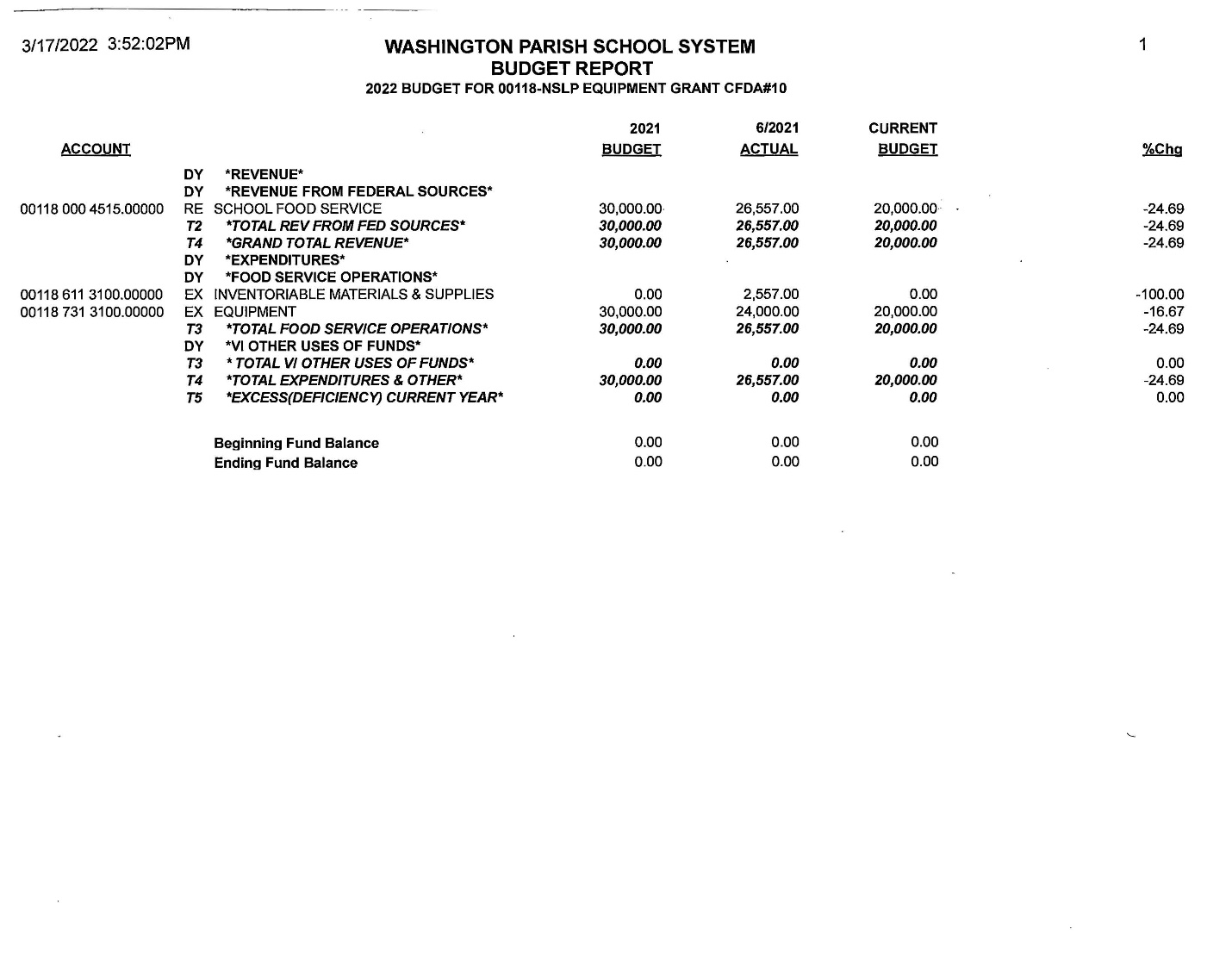

Agenda Item #21 - Consider a motion to adopt the School Lunch Equipment Grant for the 2021/2022 fiscal year (Lacy Burris).

It was moved by Kendall McKenzie, seconded by Frankie Crosby that the Board approve the School Lunch Equipment Grant for the 2021/2022 fiscal year as follows:

Motion carried unanimously.

Agenda Item #22 - Consider a motion to purchase a building together with 1.49 acres of land as per survey by Gar Real Estate and Insurance Agency Inc. on February 28, 2022 for the appraised price of $69,000.00 (Frances Varnado).

It was moved by Kendall McKenzie, seconded by Robert Boone that the Board approve the purchase of a building together with 1.49 acres of land as per survey by Gar Real Estate and Insurance Agency Inc. on February 28, 2022 for the appraised price of $69,000.00. The motion carried unanimously.

Agenda Item #23 - Consider a motion to enter into a contract with Gasaway & Bankston Architects for the design, layout Etc. of the building for the Thomas Early Childhood Center (Frances Varnado).

It was moved by Alan McCain, seconded by Dewitt Perry that the Board approve to enter into a contract with Gasaway & Bankston Architects for the design, layout, etc. of the building for the Thomas Early Childhood Center. The motion carried unanimously.

Agenda Item #24 – Personnel Report (Jennifer Thomas)

PERSONNEL ADJUSTMENTS

RETIREMENT RESIGNATION

1. Varnado High School: Michelle Reynolds, Regular Teacher, Retirement Resignation effective February 26, 2022.

2. Franklinton High School: Donna Ponthieux, Special Education Teacher, Retirement Resignation effective May 23, 2022.

SABBATICAL MEDICAL LEAVE

1. Pine High School: Becky Nave, Guidance Counselor, Sabbatical Medical Leave effective November 1, 2021 and the remainder of the 2021/2022 school year.

CHANGE OF EMPLOYMENT STATUS

1. Central Office: AnnaShea Fowler, Accountant I ESSER TO Accountant II Payroll/Insurance effective February 21, 2022 (Replacing Charlyn Hartzog).

2. Central Office: Leslie Hodges, Curriculum Coordinator of Early Childhood TO Early Childhood Supervisor effective March 17, 2022.

3. Central Office: Sharon Smith, Administrative Assistant I-Title I TO Grant Accountant II-Title I effective February 1, 2022.

RESIGNATION

1. Franklinton Primary School: McKesia Fortenberry, Cafeteria Worker, Resignation effective February 22, 2022.

2. Franklinton Jr High School: Harley Jenkins, Regular Teacher, Resignation effective March 18, 2022.

3. Franklinton High School: Deborah Rogers, Cafeteria Worker, Resignation effective February 24, 2022.

EMPLOY

1. Enon Elementary School: Terry Stewart, Custodian, Employ effective March 3, 2022 (Replacing Renee Turnage).

2. Franklinton Jr High: Daniel Hillburn, Regular Teacher, Employ effective February 21, 2022. (Replacing Chris Brown).

3. Thomas Elementary School: Margie Baggett, Custodian, Employ effective March 3, 2022. (New Position)

4. Thomas Elementary School: Jessica Bell, Special Education Paraprofessional, Employ effective March 3, 2022 (Replacing Shanda Thomas)

5. Thomas Elementary School: Melanie Knight, Pre-K Teacher, Employ effective January 3, 2022 (Replacing Misty Mulford).

6. Varnado High School: Shannon Spencer, Special Education Paraprofessional, Employ effective March 3, 2022 (Replacing Tiffany Owens).

Agenda Item #25 – Discuss and take appropriate action regarding Transportation Adjustments (Steve Knight).

It was moved by Dan Slocum, seconded by Robert Boone, that the Board adopt the Transportation Adjustments as follows:

TRANSPORTATION ADJUSTMENTS

Franklinton District: Extend the route of Donna Givens 2.5 miles one way to pick up students on Austin Varnado Road. Effective date: October 15, 2021.

Motion carried unanimously.

Agenda Item #26 - Superintendent’s Report

Add to the Agenda: It was moved by Frankie Crosby, seconded by Kendall McKenzie to consider a one –time $600.00 supplement for employees. Motion carried unanimously.

It was moved by Robert Boone, seconded by Kendall McKenzie that the Board approve a one-time $600.00 supplement to be paid on or before May 20, 2022 to all full time personnel hired by and employed on May 1, 2022. Part-time employees will receive a prorated supplement based on their schedule worked. Employees on leave without pay on May 1, 2022, will not receive the supplement. Motion carried unanimously.

Add to the Agenda: It was moved by Kendall McKenzie, seconded by Alan McCain to consider a one-time supplement equal to 4% of their base pay in the month of October 2022. Motion carried unanimously.

It was moved by Frankie Crosby, seconded by Alan McCain that the board approve a one-time supplement to all employees equal to 4% of their base pay in the month of October. In order to be eligible for the supplement personnel must be hired by and employed on October 1, 2022. Employees on leave without pay on October 1, 2022 will not receive the supplement. Dr. Wyble also noted that this is the minimum supplement that will be given in October. If funds become available this amount will be increased. The Board is also considering adjusting salary schedules to extend yearly step increases for employees with up to 35 years’ experience. Motion carried unanimously.

Add to the Agenda: It was moved by Alan McCain, seconded by Frankie Crosby to discuss and take appropriate action regarding bids received from Juban Associates and Ashton Ray for Property Appraisals. Motion carried unanimously.

It was moved by Alan McCain, seconded by Dewitt Perry, to approve Juban Associates to conduct property appraisals. Motion carried unanimously.

Agenda Item #27 - Personal Privileges – School Board Members

Colleen Bateman, public participant, spoke on behalf of the Bus Operators regarding the price of gasoline and diesel fuel. She asked the Board to take into consideration the burden fuel costs have placed on Bus Operators and to consider giving them extra money to keep the buses in service.

Agenda Item #28 – Consider a motion to enter into Executive Session for the purpose of contract negotiations with the Superintendent (John Wyble).

It was moved by Kendall McKenzie, seconded by Robert Boone that the Board enter into Executive Session. Motion carried unanimously.

It was moved by Robert Boone, seconded by Kendall McKenzie to approve a change in the word “will” to “may” in section 9 C of the Superintendent’s Contract which originally was effective February 1, 2020. Motion carried unanimously.

Agenda Item #29 –Consider a motion to return to Regular Session (John Wyble).

It was moved by Kendall McKenzie, seconded by Robert Boone that the Board return to Regular Session. Motion carried unanimously.

Agenda Item #30 –Consider a motion to adjourn.

It was moved by Frankie Crosby, and seconded by Kendall McKenzie that the Board adjourn.

______________________________

John Wyble, President

______________________________

Frances Varnado, Secretary